Compounder: Argentex PLC (LON:AGFX)

Do not take that as investment advice and do your own research. Not everything that is written below has to be right and just reflects the opinion of the author. The author has allocated capital at Argentex PLC and benefits from an increase in the share price.

1. The Pacific Family Office, which is owned by the Beckwith Family: The sons of the Founder Piers & Henry Beckwith are known for "taking live not that serious". After digging around you find some party pictures of their 21st birthday and an article on Henry being caught with cocaine. Piers and Henry Beckwith own ~9% of the shares outstanding.

2. Why has Argentex decided to IPO when they could have easily raised money through a private equity investment fund?

3. The Argentex Group was a former start-up within the pacific family office to serve its clients. The question is on how much of the growth comes from the personal relationships of the Beckwith family. Argentex has a finance exposure of around 40%.

While those are reasonable concerns and definitely nothing to ignore, I still feel good about the investment. It seems that all interests are aligned. Senior people got shares granted that will be paid out over the course of 3 to 5 years and CFO Sam Williams received 452,830 shares that will be paid out as well over the course of 3 to 5 years at an exercise price of 135 GBX (8,8% above the current price of 124 GBX). I will have to closely track the ownership of the management and any signs of disposals should raise a huge red flag.

I became aware of Argentex through the published financial figures for the year 2020. During my research, I made the job of talking with insiders. Insiders are defined as people within the industry. Why does that opportunity exist?

Argentex is a small-cap company that was authorized to the AIM in 2019. There is not much track record so far and the underlying earnings power is higher than might be assumed at first sight.

Management avoids the wrong kind of investors and is not actively promoting the stock.

Currently, more than 60% of the shares are owned by insiders and investment funds. 40% are free float. It is hard to get any shares as an institutional investor.

Currently, Argentex is covered by only 1 sell-side analyst.

Short term revenue decline forced the share price to drop below 100 GBX.

And, what makes Argentex a great investment opportunity?

At its lows at 97 GBX, it was trading at 7,8x EV/EBIT and 7,0x EV/EBITA while having the opportunity to compound with a CAGR of at least 30% over the next 10 years.

Argentex owns no more than 0,5% of the FX market in the UK and at the same time opens offices in the Netherlands and Australia. Argentex owns a small market share of the overall market.

Besides office chairs and office desks, there are no fixed assets. Argentex has an asset-light business model and the ability to reinvest their capital at rates above 30%.

Management owns around 30% of the outstanding shares

What's the Investment case here?

Argentex is a full execution case that could result in a multi-bagger. Hence some questions have to be around building up the sales team, maintain margins, and avoid risks:

How confident am I that the Management will execute in shareholders' best interest and avoid risks?

How confident am I that Argentex manages to attract and maintain the best talents?

How confident am I that Argentex will maintain the margins

Let's start with a general overview and question 1: How confident am I that the management will execute in shareholders' best interest and avoid risks?

In 2012 the Argentex joint venture is founded by Carl Jani, Andrew Egan, and Harry Adams and Pacific Investments. The founders and the family office Pacific Investments continue to hold shares in Argentex.

During my research, it was important to get an understanding of the personality of the management team. I found some people that have been working with the management team closely and left many good impressions. The management was described as very smart, humble, risk-averse, and always carrying about their reputation.

CFO Sam Williams, who joined Argentex lately, is partly compensated through options that are paid out based on EPS growth, as he is looking into building up ownership in Argentex. Senior people got shares granted that will be paid out over the course of 3 to 5 years and CFO Sam Williams received 452,830 shares at an exercise price of 135 GBX (8,8% above the current price of 124 GBX).

All of the above mentioned gives me the certainty that the interests are aligned.

Argentex is an FX Broker. Its tasks include advising and executing currency transactions and hedging. Argentex earns money from the spread between buying and selling spot contracts (immediate exchange of currency pairs) and forward contracts (futures contracts, e.g. options). Futures contracts are only used for the payment of goods and direct investments. Clients who trade currencies for speculative purposes are rejected.

The composition of customer orders and the size of trades pose a risk to Argentex. The management weighs each individual trade and does not make advance payments for trades, but requires a security deposit (initial margin). If a hedge does not develop as expected, a warning is issued to the customer, who has to cover the account within one day.

In 2020, the competitor Alpha FX (LON: AFX) had a bad debt loss of 30 million. After a USD/NOK trade was made against the client, the client withdrew from the trade. Two things went wrong: The margin account was not covered and the size of the trade compared to the whole portfolio was too high. To compensate for the loss, shares were issued and existing shareholders were diluted.

I don't have such a worry with Argentex. The management has been described to me as Risk Averse and will not enter deals that are highly profitable but have an inappropriate risk profile.

On average Argentex earns 25 basis points per transaction. While Forward Contracts account for only 1/3 of the FX business, they are responsible for 50% of the turnover.

The transactions have a recurring characteristic. As long as companies operate internationally and are exposed to currency risks, Argentex's service is required on an annual basis.

However, the demand depends on the market situation and is declining in times of crisis, as can be seen in H1 2020. In H1 2020 revenues are down 15%, even though Argentex gained 80% more customers in the same year than in the year before, and historical revenue growth rates above 30% p.a. were reported. The decline is due to the Corona situation. Customers are holding back and postponing trading activities.

In 2019 Argentex went public to realize the next growth step. The capital is used to handle larger transactions. The salaries of the shareholders have been cut, the sales team has expanded, a new office was opened and another one is planned. In Amsterdam, the first employees have been hired to take care of sales in Western Europe and work is underway in Australia. At the moment Argentex has 36 sales employees and from looking at the sales team on LinkedIn I could identify a Swedish salesperson that might be working on the Scandinavian market.

The current market for FX services is primarily dominated by banks. Banks account for 85% of the market share. Argentex targets SMEs (small and medium-sized companies) with an annual trading volume of 1m to 500m. SMEs are poorly served by banks, which is why Argentex is gaining market share there.

Question 2 & 3: How confident am I that the management will attract and maintain the best talents and margins?

The market is highly competitive. There are hardly any barriers to market entry and competitive advantages do not exist either. Only reputation and customer relations can be seen as competitive advantages. The prices are rather in the upper segment. Satisfied customers remain. Insiders have described Argentex to me as one of the few FX brokers with a good reputation while many shady market participants exist.

The corporate culture can be seen as another competitive advantage. Especially the sales team is young. The majority of the employees are under 30 years of age. People without any sales experience are primarily hired. These are then trained from scratch. Some people described Argentex to me as a great opportunity to learn sales and the best place to be in the FX space with a great work hard play hard culture.

Employees receive a salary of GBP 25,000 fixed salary and a bonus component, which represents 10% to 17.5% of the turnover of a customer procured by a salesperson. The bonus component is recurring, as a commission is also paid for business in subsequent years. The longer the employee is in the company, the more he can earn and the greater the switching costs for him, because customer relationships cannot be taken away. The following table shows the average generated turnover of an employee after different years in the company:

After 7 years of service, an employee can earn up to GBP 878,500 per year in bonus compensations. As more customers are generated, the salary increases annually. In times of crisis, when sales are declining, the bonus payment also decreases. With a fixed salary of 25,000 GBP, the fixed cost structure is very low.

All in all, Argentex compensates its people fairly, trains them regularly, and owns a great reputation in the market. I am confident that Argentex will be able to maintain the best salespeople and maintain the margins.

Valuation

The Valuation of Argentex is a little bit more tricky as I have to make many assumptions about how many people they might hire, how many they retain, what's the average revenue per employee. Hence I did some valuation models but decided that it's easier just to assume that they will be able to maintain the past growth rates of 30% annually while trading at 7x EV/EBITA. Therefore, very cheap.

Those are the current numbers and I expect Argentex to acquire more and more customers what should be the main driver for value. At the same time, I made a cohort analysis of employees.

Argentex plans to have 50 employees by 2022. I don't doubt that this number will not be reached, but I assume that most of them will leave the company. In the long term, I expect the 50 employees to be reached in 2027. Again, that target can be reached earlier.

From this, the turnover per year of employment and the cohort analysis can then be used to calculate the turnover. For employees hired before 2020, an average value of 1,152m is calculated. This decreases in 2021 as trading activities decline, but grows continuously by 300k to 600k p.a. in the following years.

In the next step, I've been working on splitting up the current cost base and that was my result. I assume that the LLP members earn 17% of the revenue and that other costs are at 8%.

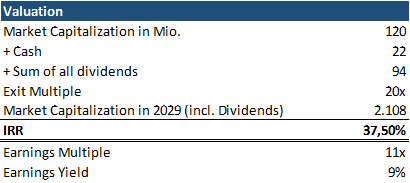

Currently, Argentex is trading at a market capitalization of 120 million while having 22 million in net cash. I assume an exit multiple of 20x on 2029 earnings. Argentex will have paid out 1/3 of its earnings until then resulting in GBP 94 million in dividends. The expected IRR is 37,50% per annum.

I have invested 23% of my portfolio in LON:AGFX and bought Argentex at an average purchase price of 130 GBX