Compounder: Instalco Ab (STO:INSTAL)

Do not take that as investment advice and do your own research. Not everything that is written below has to be right and just reflects the opinion of the author. The author has allocated capital at Instalco Ab and benefits from an increase in the share price.

EDIT: Sold INSTAL on the 12th of January 2021 for an average price of SEK260 or after ca. 170%.

Instalco Ab is a Stockholm based asset-light roll-up that provides installations and services within the disciplines of heating and plumbing, electrical, ventilation, cooling (in short HVAC), and industrial with a strong presence in Scandinavia.

What makes Instalco Ab an attractive investment?

Small market share and huge TAM: Instalco has a market share of less than 3% percent in a SEK 170 billion market with more than 25,000 service providers below 80 million in revenue and will be able to continue its growth rates of at least 15% through acquisitions.

Moderate valuation: On the FY2019 numbers Instalco is valued at 22x FCF while growing earnings by more than 15%. Assuming that a 22x FCF is a fair multiple would imply that Instalco could double at least every 5 years.

Competitive advantage: Due to the size of the business Instalco has a strong competitive advantage over his smaller competitors who are not able to provide the same service due to the lack of size and service offerings. The moat is widening as Instalco acquires more and more businesses.

High reinvestment rates: The internal rates of return are phenomenal. Instalco managed to reinvest their capital at an average of 29%.

The combination of all the above should return superior returns over the next 10 years.

General business description

The company itself was founded in 2014 by Per Sjöstrand who owns 8,5% of the company. Back then, he acquired 5 larger companies and formed a group. 3 out of 5 of those acquisitions are active in heating & plumbing while the other two are divided between electrical installation and ventilation. Since then Instalco managed to acquire more than 75 different businesses all around Scandinavia. 4/5 of the revenue is earned in Sweden and 1/5 in Finland, Norway, and Denmark.

The current activities are split into three segments: Electrical, heating, and plumbing systems and ventilation and cooling systems

Electrical installations involve the design, project planning, fitting, service, and regular maintenance of electrical systems in properties. Technical areas for electrical installations include, for example, low voltage, high voltage facilities, alarm and surveillance systems, as well as energy optimization.

Technical areas within heating and plumbing include, for example, pipe and heating systems, plumbing replacement, and district heating.

Ventilation and cooling systems involve, for example, installation, maintenance, air treatment, air-conditioning, and climate control, often with a strong focus on energy efficiency. Technical areas within HVAC include indoor ventilation, cooling systems, heating pumps, and kitchen installations among other areas.

Their customers are either active in the construction sector or the industrial sector. The high margin recurring business is the service part where Instalco is currently working on and aims to have 15% to 25% percent of the business in that area. Right now, Instalco is dependent on projects and tenders. The service is divided into three main types: Services within new construction, maintenance, and renovation.

New construction services include the installation of technical systems in connection with the construction of new properties. That area is strongly dependent and driven by macroeconomic factors.

Maintenance services include maintenance work on technical systems in properties and aims at extending the life of property installations. Maintenance is usually prioritized over building new buildings. Therefore, it is less dependent on the current macroeconomic conditions.

Renovation services include the installation and service of technical systems in connection with reconstructions. That segment is driven by the age and standard of a building an not as much affected by the macroeconomic factors as the construction of new buildings

Due to the current market which consists of 2/3 of maintenance and renovation and 1/3 of new constructions the dependency on macroeconomic events is low and revenues shouldn't fluctuate strongly in economic downturns. The American service contractor for building fire safety API Group (NYSE: APG) lost 20% of its revenue in the crisis from 2008 to 2010.

Scale as a barrier to entry and competetive advantage

As I mentioned before Instalco is active in a market with more than 25,000 installation companies with less than SEK 500 million in sales, less than 10 employees, and focus on only one technical service. Those circumstances lead to a large competitive advantage in terms of economies of scale and wider services.

The more companies Instalco acquires within one region the more attractive it gets for its customers. Larger size leads to the ability to provide more manpower and different technical services for their customers. Meaning Instalco turns into a one-stop-shop where customers are able to get the full range of services they demand.

Assuming that a customer needs more than 10 people for a larger project would indicate that 90% of the service providers wouldn't fit. In addition, larger size means better stability and certainty. Hence larger and mid-size projects are only tendered between larger companies like Instalco or the current market leader Bravida (STO: BRAV).

That moat should widen over time as Instalco grows in size, network, and provide more services like fire safety, electricity, or building security.

Acquisition Strategy - buy & build & hold

Since 2014 Instalco acquired more than 75 companies with a total turnover of more than SEK 5 billion in revenues. Most of the growth is related to acquisitions.

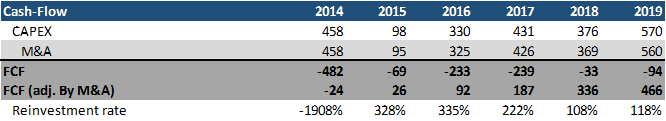

In the admission document, Instalco mentions that they pay a multiple of 4.2x EBITA without taking synergies into account. Bravida mentions in their admission document that their EBITA multiple is at 5x before synergies but decreases to 2,5x EBITA after synergies. That explains the phenomenal ROIC of 29% on the M&A part of the business:

Since the foundation in 2014 Instalco acquired more than SEK 655 million FCF by investing SEK 2.233 billion in acquiring businesses. There are not many companies that provide such returns.

Instalco has a very decentralized structure and maintains the management teams and the brands of its subsidiaries. They are so decentralized that their subsidiaries can choose if they want to benefit from centralized purchasing or not.

Besides that Instalco provides training and best practices within the group and organizes gatherings. Instalco's companies not only share best practices but collaborate on different projects together.

There are many reasons to join Instalco especially on the synergies part as companies are able to cooperate and go for cross selling their services.

The acquisition targets are discovered by their business unit managers who look for interesting companies they would like to add to the group. These companies should have the following characteristics: Strong market position, highly cash generative, stable and profitable, competent management team, and cultural fit.

Important to note once more is that their acquisition strategy widens the moat. More companies within the group providing different services lead to the competitive advantage I mentioned before.

While there are more than 25,000 companies in the market Instalco could look for new business areas within their value chain, for example, building security, energy, automation, or fire safety, or grow in new markets, but keep in mind that not every market is as fragmented as Scandinavia, for example, the top 3 companies own 40% of the market share in France. Instalco could even start to acquire loss-making businesses and turn them around as soon as they got more expertise in how that might work out.

Interestingly, Instalco acquired MESAB, a service provider for the maritime industry. Not sure if I like that but the economics should be similar.

Currently, Instalco is reinvesting more than 100% of its FCF in acquisitions and the company should be able to maintain that acquisition pipeline for a very long time.

While the business is great it is not free from risks. Especially, on the m&a side the depends on the management execution. Any overpaid acquisition should raise a red flag.

New participants, who are working on consolidating the building service market and compete against Instalco could lead to an increase in acquisition multiples and therefore, decrease the ROIC.

Valuation

Instalco gets some headwind from the Swedish Million Programme in 1965. Back then, the Swedish Government decided to construct one million new homes and managed to build 1,006,000 new dwellings. Those houses turning slowly into the renovation and due to the popular housing shortage in Sweden Instalco will be busy for a very long time.

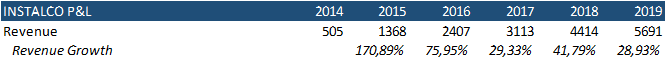

The revenue growth rate is astonishing, but keep in mind that most of it is inorganic growth and should slowly come down as it might get harder to deploy capital.

The overall financials look good as well. Other operating income and other operating costs mostly consist of one-offs like amortizations or acquisition-related costs.

While revenue is growing strongly, Free Cash-Flow is growing even stronger:

Assuming that the current multiple of 22x FCF is fair due to the quality of the business and the high growth rates and that Instalco will deploy 70% of their FCF at 20% ROIC while paying out the other 30% and be able to grow organically in the lower single-digit will result in an annual expected return of 17% p.a.

My assumptions are more on the lower end as that case could turn out way better.

Instalco could improve margins due to the higher service business.

The current ROIC on acquisitions is at 29%.

Organic growth has been historically higher.

I am long on STO:INSTAL and 27% of my portfolio is allocated to Instalco at an average purchasing price of SEK 103