Micro Cap: KINOVO PLC at 7x FCF (200%+ upside)

Okay, Guys, as always. Here is the disclaimer:

Do your own Due Diligence. The author (me) is invested in Kinovo. I own shares and if you think about buying shares of this business keep in mind that even a small investment from your side will move the needle and it's not easy to liquidate if you want to get out. Obviously, I'll benefit from an increase in share price.

Cheers, here's the link to my Twitter thread and let's start.

My whole idea generation process comes down to reading daily financial releases. Same for the case of Kinovo. The first time I came across the company was in summer 2020. The company was trading at about GBP12m in market cap (or half the market cap as of today 2021-11-04).

At that time, Kinovo PLC was still known in the market as Bilby PLC. Unfortunately, the company is barely traded. Only GBP20k in shares move hands-on average every day and I decided to pass.

Then, in Summer 2021, Kinovo PLC reports FY 2020/2021 earnings - boom. Meanwhile, the market capitalization moved to GBP20m and I decided to dig a little bit deeper.

let me tell you why that opportunity exists:

We are talking about an illiquid micro cap with GBP20m in market capitalization and an average trading volume of GBP20k per day. Only retail investors (people like me) will buy shares. For institutionals it is just too illiquid.

High historical dilution with a super ugly share price track record

Elevated earnings / earnings manipulation that blew up

0 analyst coverage

AND we have non-cash purchase price amortizations that hide the underlying profitability. Therefore, the company is not mechanically "screenable".

It's a great set up, isn't it? But let me continue what makes it even better:

Kinovo trades at a 14% normalized FCF yield (or 7x normalized FCF). Just the electrical services and the gas maintenance business has an acquisition value of GBP66m (that alone is an upside of >200% on my purchase price)

The company just emerged out of restructuring efforts with a completely new management team.

New CEO just established a whole new business development team that will work on winning new business related to the just announced governmental renewable energy act of the Great Britain.

Alright, let me explain what happened historically and provide you with a little bit of an insight into the business.

The former owner rolled P&L installation company into BILBY PLC. Bilby was the holding entity and IPOed in 2015. Bilby was part of a roll-up strategy with the goal of consolidating building, gas, and electrical services. It took 4 years to acquire 4 additional businesses and to blow up the company.

The whole group consisted of 5 companies: Purdy, Spokesmead, DCB, R. Dunham, and P&R Installation Company (the business was closed down and merged into Purdy).

A real life case study on how to spot a ticking bomb

Let me explain what happened. P&R installation company has won two contracts. Obviously, not well calculated/negotiated, and that were cash burning. One with the Ministry of Defence and one with East Kent House. As you can see below, the P&R business unit started burning cash while the other business units have been profitable. P&R went from 1,002 down to (2,054) in EBITDA.

In 2019, the financials got hurt. Kino terminated those contracts and started a resolution process. EBIT decreased from GBP4.5m to (GBP10.1m). Dozens of one-offs appeared.

(1.802) Impairment of Acquisition intangibles

(7.604) Loss on Exit of the contracts

(0.424) Impairment of Accrued income

(0.975) Restructuring Costs

The most important question here is "have there been any red flags?"

There have been red flags and not just one. Let me guide you through a few.

No. 1: The first have been the fact that Bilby was using "percentage of completion"-accounting.

What does that mean? Imagine, you are a building contractor and win a tender to construct a building over the period of 5 years. If you do it properly you'll construct 1/5 of the building per year and book 1/5 of the revenues per annum, but POC allows the contractor to record revenue and earnings upfront without a cash payment received.

Companies that use that method are asked to estimate the proportion of the project that has been completed and then pro-rata the part of the project's revenue, expenses, and earnings can be recognized. There are dozens of examples of "POC frauds".

Before the collabs, you could see some anomalies in the financials in FY 2018:

The first red flag within the financials has been the improved 2018 Net Revenue margin that improved by 5%.

The second red flag was the FY2018 adjusted EBIT-Margin that improved by ~3%

The third red flag was the accrued income that doubled while revenue growth did not.

There is one more red flag, but it wasn't possible to see this one at that time as Kinovo did not disclose its margins by revenue streams.

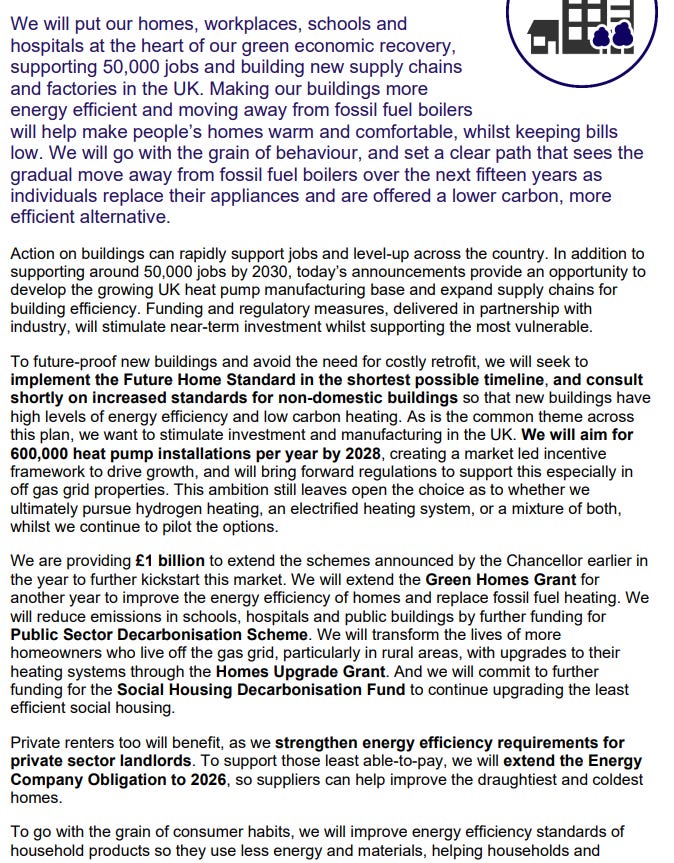

I tried to get a hold of the underlying building services margin by applying 2020 margins on the historical revenues. That's what you get:

What you see is that the Building Services margin increased from 4.52% to 10.07% in 2018. Peers have a margin of around 5%. Obviously, the building services business was too profitable and something was going on here. Usually, frauds tend to overdeliver and overperform.

The turnaround

The whole story blew up and has put a hole in the financials of Kinovo. The new CEO David Bullen, who joined Kinovo in 2019, was hired to restructure the business.

In 2019, David implemented a new centralized process on bidding, introduced a CRM, and recapitalized the business (David participated with his own money at GBP0.10).

A year later, he resolved the claims with the Ministry of Defense and East Kent Housing, he centralized the back-office, improved governance, restructured covenants, and debt facilities. Today, Kino has available debt facilities of GBP9.8m

In 2021, he rebranded the company from Bilby PLC into Kinovo PLC, set up a business development team, introduced a corporate-wide share incentive plan, and repositioned the business for the governmental renewable energy act.

David Bullen Microcap Superstar

An important note here. David Bullen is a stellar CEO. Before Kinovo he was the CEO of Anpario PLC where he quadrupled the share price, acquired a business for 5.5x net profit, grew revenue by 50%, improved gross margins by 50%, and doubled operating income.

What's next for Kinovo?

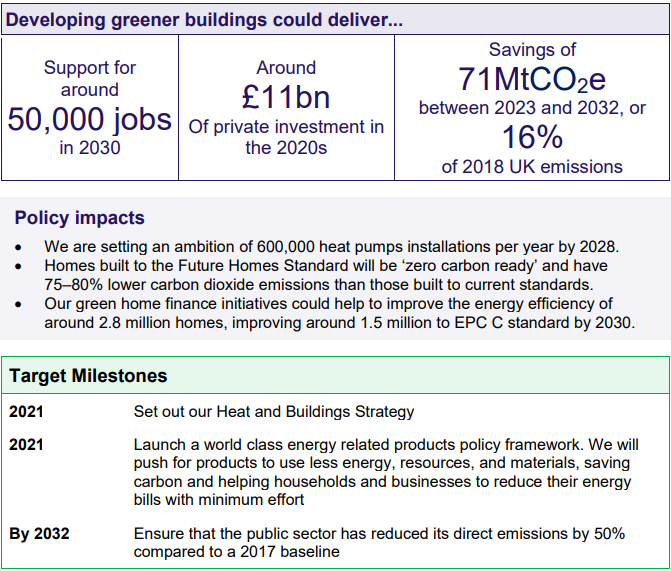

in 2020, the UK government pledged to achieve zero emissions by 2050 through a "Ten Point Plan" The most important points are Point 4: Shift to zero-emission vehicles and Point 7: Greener buildings where Kinovo sees the opportunity as they provide electrical services and gas installation. Below you find the excerpt. Feel free to read it.

Understanding the financials & Valuation

In 2021, revenue declined by about 8%. The main driver was the decline in electrical services. Customers did not let the electricians in and services had to be postponed. The revenue mix changed and the net revenue margin decreased.

I expect that revenues will rebound to pre-covid levels at the latest by 2023 as the situation softens. The revenue mix will lead to a margin improvement, too.

On top of that, the building services business should improve in profitability. Competitors earn 5% EBIT-Margins compared to 2.58% for Kinovo. Historically, the business was in between 4% and 5% (without the outlier in 2018).

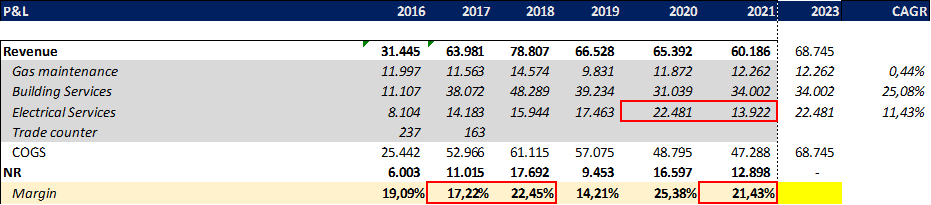

The main reason why the part of the business underperforms are so-called "unsatisfied service contracts". Those will be finalized by 2023. I believe that those are contracts that have been poorly negotiated. Half of the contracted revenue is low margin while the other half should be average.

The next important financial item is the "amortization of acquisition intangibles". When a company acquires another company as an asset deal the acquirer has the option to amortize intangible assets, for example, customer relationships. Those customer relationships are not cash-effective but they decrease earnings and are tax deductible.

That means that the Free Cash Flow is higher than the reported earnings. After adjusting the earnings further by covid relief we get to the following earnings power. By 2023 the company will be debt-free and produce FCF of at least GBP2.87m.

Besides that, there are still GBP2.489m in customer relationships on the balance sheet worth around 470k in tax deductions. To not make it complicated we assume that Kinovo will use all of its FCF to pay down debt and by 2023 Kinovo will be debt-free and net-cash.

Valuation

I acquired shares of Kinovo at 34 pence or a market capitalization of ca. GBP20.5m. Divide the GBP20.5m by GBP2.872m in FY2023 owners' earnings and we get to a multiple of 7x OE

What we get here is:

a 14% FCF yield + further organic growth + multiple expansion.

On top of that, Kinovo is able to use its GBP10m in debt facilities to pursue an m&a strategy. David Bullen acquired a business for a little bit above 5x earnings at his former position. Why shouldn't he be able to do it again?

Another option is that Kinovo will be acquired. in 2011, Pimlico Plumbers was sold for 2x Revenue to KKR:

https://www.proactiveinvestors.co.uk/companies/news/960865/pimlico-plumbers-sold-to-us-company-neighborly-960865.html

In that case, the market value of the Gas Maintenance and Electrical Services business is worth around GBP66m or 21x Owners Earnings and implies an upside of more than 200%.

It just seems to be too cheap to ignore and it will take some time until the market recognizes that opportunity. Until then, I'll have at least doubled my money.