Playboy (NASDAQ: PLBY) / Mountain Crest Acquisition Corp (NASDAQ: MCAC)

Disclaimer: As always, do your own research. This is not investment advice. Everything below might be wrong. The publisher of that article is invested in the company stated.

Update:

I sold my position in PLBY after the 1st Quarter 2021 earnings which have been disappointing as I was expecting a much better one. Since I bought shares at $11,10 the share price went up to $60 and came back to $40. I sold my shares at a little bit less than $44. The reason for the selling was the inflated share price and some questions that made the investment less attractive.

While the bull case was a renegotiation of the licensing business, the management wasn't talking about that low-hanging fruit that could triple the high-margin licensing business. As I do not understand why Ben Kohn is not addressing that potential and do not understand the licensors in China, I believe that my lack of knowledge does not justify a confident holding in PLBY at 7x forward revenue. At the same time, PLBY only earned 5% on the GMV in the US.

Opex increased by 15 million. Even after adjusting one-offs, it still hasn't scaled. As I do not understand why the company does not manage to scale the business even after how they call it a "great year".

YoY adj. Licensing grew by "only" 8%. I was expecting a much stronger growth rate. Taking the termination of the licensing contract into account, licensing revenue declined YoY.

I might consider a position at half the current price again, but for now, I have to look for other investments where I may deploy 50% of my cash position.

Investment Thesis

I will save some time introducing the Playboy brand as I am sure you have heard about the iconic magazine showing celebrities like Marilyn Monroe, Kate Moss, or Madonna and interviewing revolutionaries like Malcolm X, Martin Luther King Jr., or Steve Jobs.

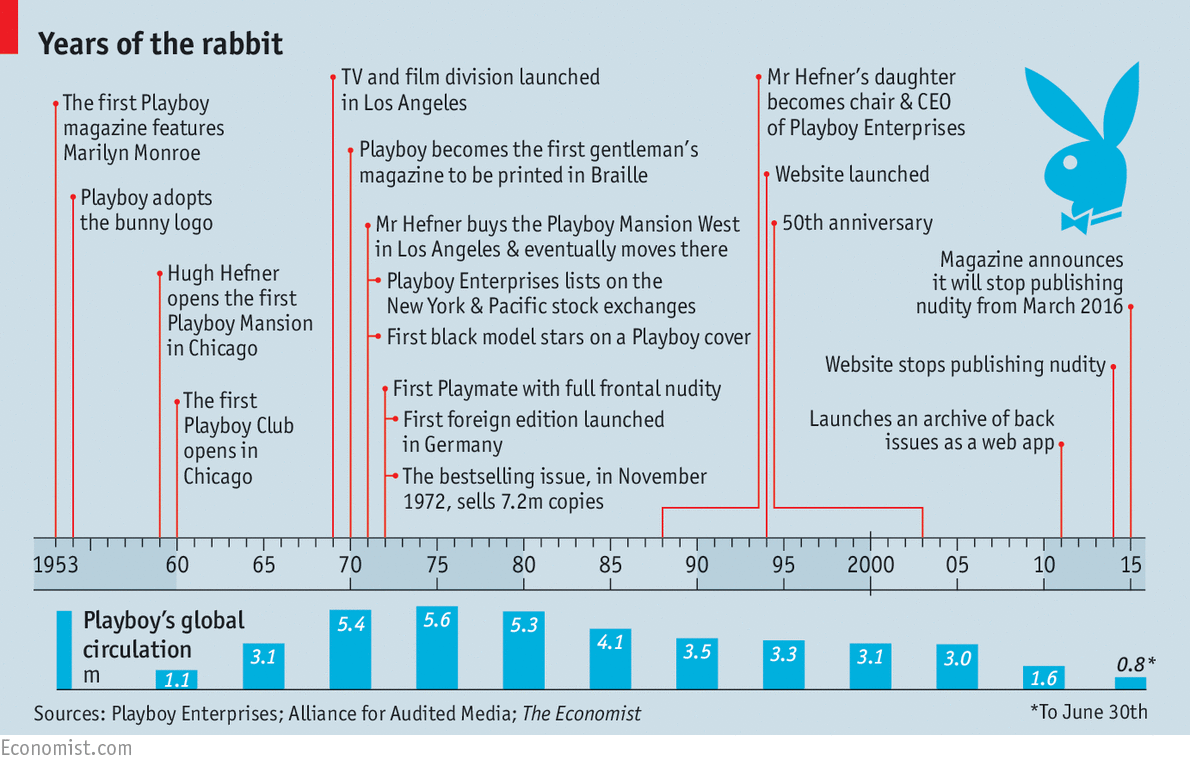

What started by Hugh Hefner in the 1950s as a print business found its legacy during restructuring efforts in 2020. Ben Kohn took the opportunity and shut down the print business completely when the circulation of the magazine went from 5.6 million in 1975 to below 0.8 in 2015. What's left of playboy is a turnaround strategy to leverage its brand through a licensing and direct 2 consumer business.

In 1973 Playboy Enterprises Inc. went public for the first time and has been taken private in 2011 again by Rizvi Traverse Management, a deal that valued the company at $207 million. Rizvi was founded by Suhail Rizvi, a Silicon Valley Investor, who had an interest in Snap Inc., Twitter, and Square. The firm owned 60% of Playboy Enterprises while the other 30% were held by Hugh Hefner and 10% by the management. After Hugh's death in 2017, the remaining stake was sold to Rizvi Traverse Management.

9 years after going private, Rizvi Traverse decided to go public again through a reverse IPO. From a shareholding perspective, the IPO seems to be more kind of a capital raising rather than an exit. The entire ownership of Rizvi was rolled into Mountain Crest Acquisition Corp. (NASDAQ: MCAC).

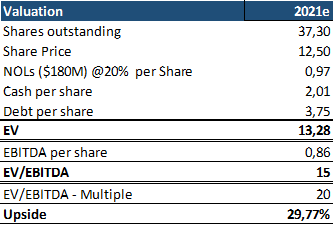

There will be around 37.3 million shares outstanding and at a price of $12.65 per share the combined entity will be worth ~470 million while having $100 million in cash, $100 million in debt, and $180 million in NOLs worth around $38 million in tax savings. Playboy will keep owning 66% of the combined entity. The remaining shares will be owned by PIPE investors, SPAC sponsors, SPAC investors.

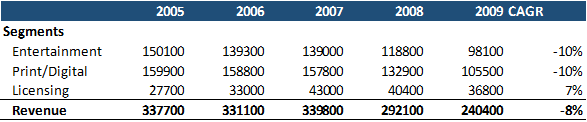

Before going private in 2011 Playboy was segmented into entertainment, print/digital, and licensing business. What's left is a licensing and direct 2 consumers business while those are further divided into sexual wellness, style & apparel, gaming & lifestyle, and beauty & grooming. 95% of its revenue is earned in sexual wellness and style & apparel. For example, Playboy operates a Casino in partnership with Caesars in London and launched its furniture collection on Wayfair.

Before taking the business private, Playboy was growing its licensing business until 2007 before it started to decline. The Entertainment and Print/Digital business has been in decline for the last reported years. Playboy was always mismanaged by the Hefner Family and the print business was burning up to $7 million annually.

From 1988 until 2009 the company was managed by Christie Hefner. She stepped in when the business was reeling from losses. She shut down the playboy clubs, introduced playboy TV, and grew the business, while Hugh was against it, into hardcore pornography by buying spice TV and Club Jenna. Under her management, she grew the $1 billion licensing division and managed to get the business profitable in good times.

In 2008, Christie resigned. The decision came at a time when Playboy struggled to compete at widely available free pornography and Playboy announced that they considered a sale or to change the direction of the business.

The next year, Scott Flanders stepped in as the new CEO. His restructuring efforts streamlined the business from 585 people to 165 people (211 today), closed down and outsourced the entertainment business, for example, Playboy TV is operated and licensed by Mindgeek Holding SARL. Mindgeek is the owner of some very well known brands and websites in the online porn industry.

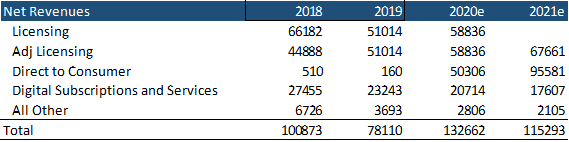

Today, Playboy Inc. is in a way better shape than it has been a decade ago. Ben Kohn, the partner at Rizvi Traverse, stepped in as the new CEO in 2017 without being attached to the former legacy. He closed down the advertising business, acquired Yandy.com and loversstores.com, and continued to grow the licensing business. Since taking over as the new CEO the licensing business went from $44,89 million to $58,84 million.

Consumers spend around $3 billion on licensed Playboy products and Ben Kohn took the initiative to transition the business from licensing to owned & operated to catch some of the total consumer spendings. At the same time, he is working on collaborations with some of the best know brands like Supreme, Anti-Social Social Club, or Moschino while expanding into physical retailers like Urban Outfitters and Macy's. In 2021, Playboy released a collaboration with Steve Aoki that was immediately sold out.

Overall, the strategy is to acquire further businesses and to launch their own B2C shops to penetrate the consumer business even stronger. In 2019, playboy launched pleasureforall.com and playboyshop.com and acquired lingerie shop Yandy.com for $13.1 Million. The business added $40 million in revenues within the first nine months. Two years later, Playboy acquired loversstores.com for $25 million with an annual revenue contribution of $45 million.

Weird at Playboy is the communication of the CEO Ben Kohn with its investors. Instead of communicating on a earnings per share basis, the management provides adjusted EBITDA numbers and misleading revenue growth rates. No separation between organic and inorganic revenue growth was made. Therefore, Peer group comparison in their investor's presentation do not make sense as growth rates are overstated.

In addition, the management states that they've signed a 12-month lock-up, but does not mention that they are allowed to sell half of the ownership as soon as the share price hits $14.00 for 20 out of 30 trading days.

Notwithstanding Section 1(a) above, if the volume-weighted average price of the shares of PGI Common Stock equals or exceeds $14.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30 consecutive trading day period, fifty percent (50%) of the Shares shall be released from the lock-up to the Holder.

LOCK-UP AGREEMENT

On top, there are some further questions left:

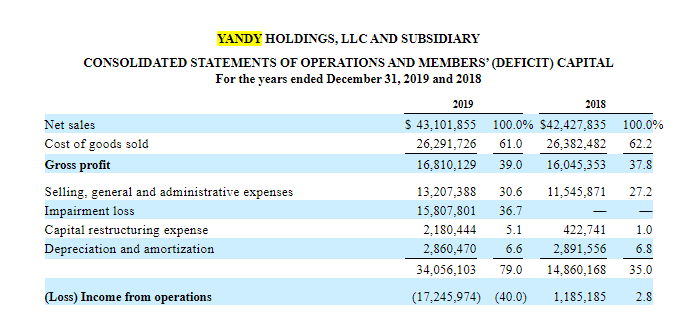

I am not sure how value-enhancing the acquisitions are. While they paid $12 million in cash for Yandy, they acquired around $19 million in debt, too. The business was even burning cash and going through a restructuring.

The compensation of Ben Kohn seems to be out of average. In FY 2019 he earned a fixed salary of $1 million while receiving another $3.8 million in RSU and stock options. At the same time, he is compensated on unfavorable adj. EBITDA targets. On the other side, he will not be granted any shares for 2020, and with an exercise price of $18.73 and owning around 1 million in shares, Kohn benefits from an increase in the share price.

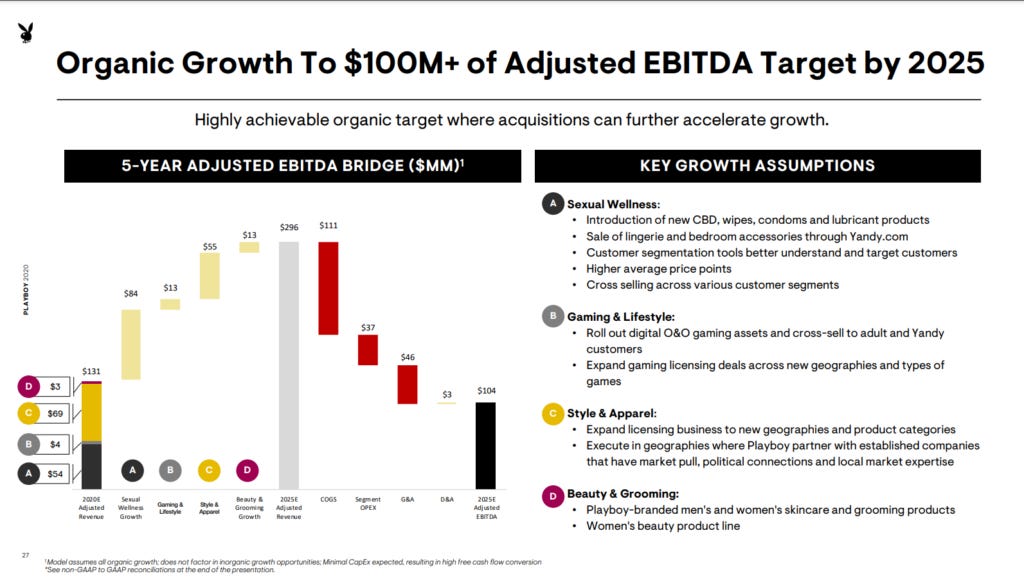

The guidance of $100 million adj. EBITDA in 2025 seems to be very aggressive. It is questionable, how many of the unusual costs will keep recurring and if Ben is going to reach that target. I would prefer to see the direct to consumer business get profitable on a not adjusted EBITDA first.

Valuation

The valuation of PLBY is a little bit more tricky due to the many one-offs and a few that I cant explain. I believe some of the stated costs are recurring.

The contract termination in 2018 was a one-off resulting in deferred revenues of $21.294 million.

Stock-based compensation has been something I've been struggling with understanding. While it decreased in 2020 it was still a large part in 2019 and 2020. Therefore, I decided to assume 50% of the 2020 costs as recurring.

The restructuring should follow on at least at the resent acquired assets. Therefore, severance pay (reduction in force expenses) should be partly recurring.

The non-recurring items relate to the restructuring efforts, for example, terminated lease agreements and brokerage fees for its new office and a step-up of inventory value related to the Yandy acquisition.

The management fees are recurring as Playboy pays $1 million annually to Icon Acquisition Holding.

The litigation and settlement expenses are one-offs. One of the lawsuits was related to the privacy issue. The company shared its subscriber information with third parties without obtaining consumer consent and the other was related to a license breach between Playboy and Hugh Hefner. Both lawsuits have been settled.

The licensing business was at $37 million in 2009 and declining. In 2020 it's $59 and growing by 15% while having a 70% EBITDA-Margin. I estimate a further 15% YoY growth for 2021 with a 70% operating margin. Most of the revenue is billed in the first and third quarter as licensees pay 6 months upfront.

The Direct to Consumer business increased to $50 million in 2020 due to the acquisition of Yandy. Yandy added around $11 million in operating expenses and $19 million in debt on top. In 2019 the company had $2 million in restructuring expenses and a $16 million goodwill write-off resulting in adjusted earnings close to zero in 2019. 10% should be a fair operating margin for an e-commerce business. I take that one as a free option as the direct to consumer hasn't been profitable yet.

The Digital subscriptions and services, business, which consists of subscriptions related to their media business, was in a permanent decline. The management is squeezing the business as much as possible. The operating profit margin increased from 22% to 45% while the business declined by around 25% over the last 2 years. Digital subscriptions and services will continue to decline.

With 37,3 million shares outstanding and $0.97 in NOLs, $2.01 in cash, $3.75 in debt and $0.86 in EBITDA per share for 2021 Playboy trades at 15x EV/EBITDA. Playboy could trade even higher due to its strong franchise, asset-light business model, and strong organic growth.

On top of that, the licensing business provides downside protection as long as the underlying business isn't declining. The licensing business alone could be worth the entire market cap as the acquisition value of a company like Playboy, a highly profitable, double-digit growing, and low CAPEX business should at least be 10x EBITDA. According to WSJ, the business was worth $500 million in 2016 (including the playboy mansion which has been sold for $100 million in 2016).

All in all, either Playboy is a dead brand that Rizvi Traverse Management wants to liquidate after 10 years and markets the story the best way possible or it always has been a mismanaged company, and now under new leadership, it might be able to rebrand itself and get a chunk of the $3 billion consumer market it addresses and would be much more worth in a few years than it is today.

What speaks for a successful rebranding is its collaboration with some of the best-known apparel brands and collaborations with celebrities like Steve Aoki, while interviewing Kylie Jenner and Travis Scott. With around $75 million in cash and $100 million in debt, the balance sheet cleaned up.

I do not have all the answers, but the Playboy brand doesn't seem dead to me and it's still belongs to the most prominent ones in the world. Hence I initiated a position at an average purchase price of $11.10 in NASDAQ:MCAC / NASDAQ:PLBY

Further reads:

https://www.nytimes.com/interactive/2015/10/13/business/playboylisty.html

https://www.nytimes.com/2019/08/02/business/woke-playboy-millennials.html

https://www.wsj.com/articles/SB10001424127887324432004578304102041831988

https://www.wsj.com/articles/playboy-ceo-exits-as-magazine-explores-sale-1464735204

https://www.economist.com/united-states/2015/10/22/sex-doesnt-sell-any-more

https://foreignpolicy.com/2016/02/15/playboy-is-ditching-the-sex-and-betting-on-china/