Spin-off: Aaron's Company (NYSE: AAN)

Do not take that as investment advice and do your own research. Not everything that is written below has to be right and just reflects the opinion of the author. The author has allocated capital at Aarons Company and benefits from an increase in the share price.

Sold my AAN shares for $29,10 on the 28th of July 2021 with a 44% gain. I might have overstated the cash-flow the company might be able to generate. It still doesn't look expensive but not super cheap either. The asset write-offs seems to be lower than historically. It might happen that they increase. In that case, the company would generate between $70 to $80 million in FCF and tradin at around 15x.

First of all, let me apologize for posting this one late. I had it in draft for some time and decided to complete it. I guess, it gives a great overview of how I screen and value businesses. Have fun.

It seems like brick-and-mortar businesses get out of fashion, especially, when they are spun-off. Otherwise, I can't explain why Aaron's Company (NYSE: AAN) lost around 65% of its value within one month. AAN opened at $35.60 and moved down to $16.37 while currently trading at $34.77 per share.

Let me start with "why did that opportunity exist?" and introduce the post-split-up companies Progressive Leasing (PROG) and Aaron's Company (AAN).

Progressive Leasing is a virtual lease-to-own company that provides lease-purchase solutions in 46 states and the District of Columbia. It does so by purchasing

merchandise from third-party retailers desired by those retailers' customers and, in turn, leasing that merchandise to the customers through a cancelable lease-to-own transaction. Progressive Leasing consequently has no stores of its own, but rather offers lease-purchase solutions to the customers of traditional and ecommerce retailers.Source: 10-K

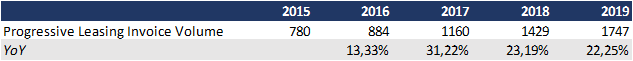

As to understand, PROG is a fully digital solution for subprime lending that buys and leases furniture and appliance (53%), Jewelry (16%), Mobile Phones and Accessories (12%), Mattresses (10%) and automobile electronics and accessories (7%) directly from the retailer to the customer and doesn't operate any brick and mortar stores. As you can see in the next picture, the leasing invoice volume is growing by double digits. Leasing invoice volume is defined as inventory that has been acquired and leased to the customers netted by received payments.

What do shareholder get on the other side?

The Aaron's Business segment offers furniture, home appliances, consumer electronics and accessories to consumers through a lease-to-own agreement through the

Company’s Aaron’s-branded stores in the United States, Canada and Puerto Rico, as well as through its e-commerce platform. This operating segment also

supports franchisees of its Aaron’s-branded stores. In addition, the Aaron’s Business segment includes the operations of Woodhaven Furniture Industries

("Woodhaven"), which manufactures and supplies the majority of the bedding and a significant portion of the upholstered furniture leased and sold in Company-operated and franchised storesSource: 10-K

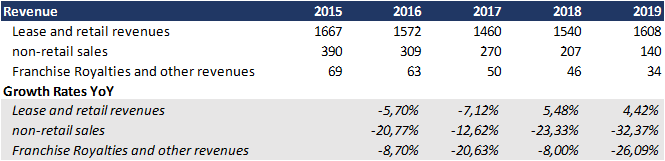

So, AAN is operating around 1.300 subprime loan brick and mortar store around the US that lease furniture (44%), home appliances (27%), consumer electronics (20%), computers (6%) and other (3%) directly to the customer. Over the last 5 years, AAN was experiencing declining revenues and the company is going through a restructuring process.

All in all, it is not a mysterium why AAN declined by 40%. Who wants an outdated brick-and-mortar business model when you can own a growing high ROIC and asset-light business with no inventory?

Let me tell you why that company was super interesting and what the market was missing.

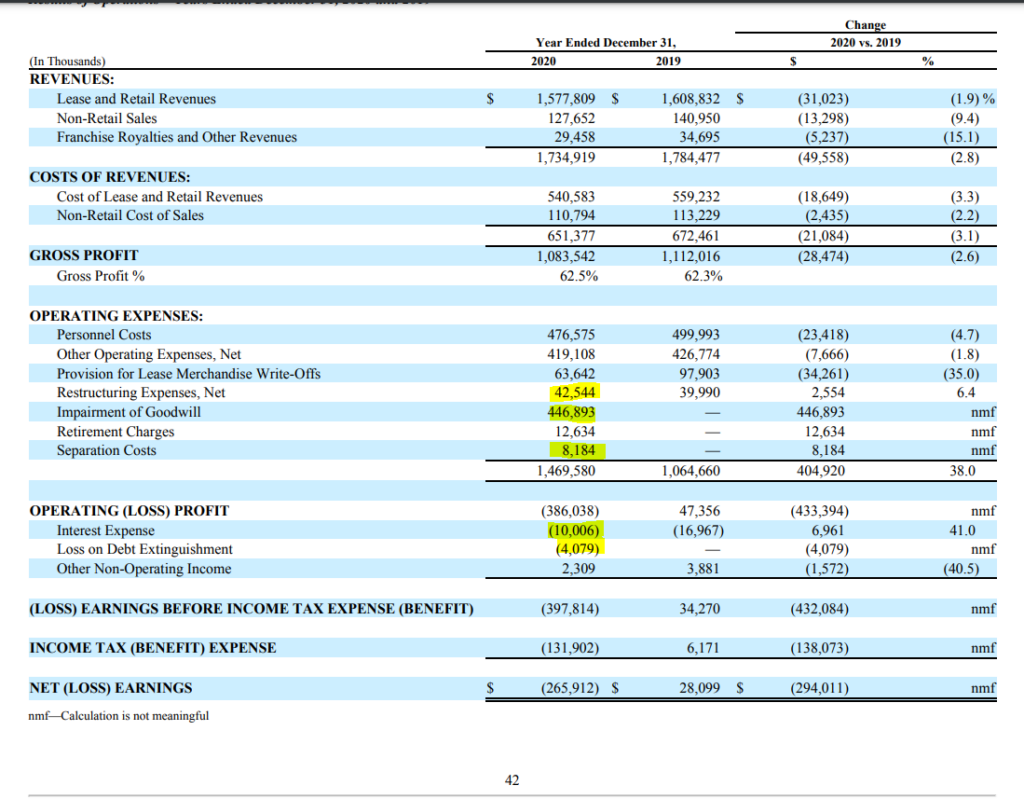

The first thing you see is a net loss of 265 million, revenues are in decline, we have a huge pile of restructuring expenses, 10 million in interest expenses. Unsexy, isn't it? The separated company looks much more attractive.

AAN emerged with 45 million net cash and no debt. There are no further interest expenses to expect. +$10 million in EBT

The retirement charges are related to the retirement of the former Aarons Holdings CEO. Therefore, a one-off. +$12 Million EBT

Separation costs and loss on debt extinguishment are one-offs. +$12 Million in EBT

The goodwill impairment of 446 million for the acquisition they did in 2020 is not cash effective. +$446 million in EBT

The revenue is declining as AAN is restructuring the portfolio and closing down branches. Meanwhile, they started with new concept stores and same-store sales started to grow over the last quarters in the single digits while e-commerce is growing double-digit. The company is closing down stores that are close to each other. They closed down 94 of their own stores and 72 franchised stores resulting in restructuring expenses of $42,5 million or ca. $250K per store.

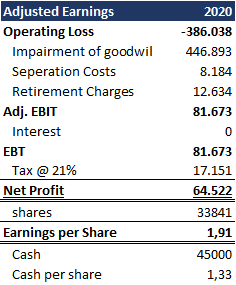

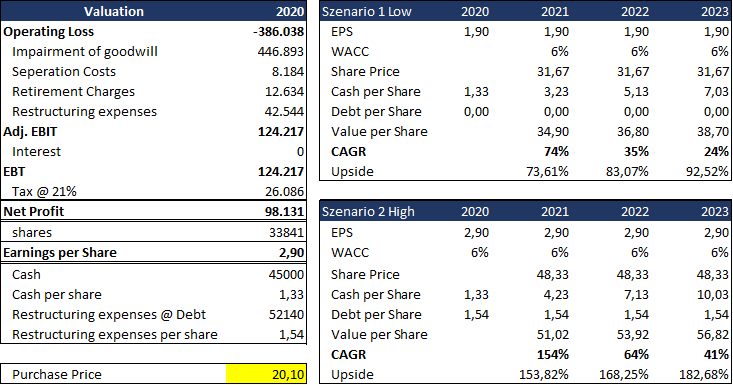

Now, how much free cash-flow is AAN generating? Voila, see below:

AAN generates a net profit of $64,5 million or $1,91 per share with $1,33 per share in cash. I bought shares for $20,10 or for a cash adjusted P/E multiple of 9,8x. Cheap, isn't it?

We can get that stuff even cheaper. We got restructuring expenses of another 45 million. Let's give AAN 4 years to restructure the entire portfolio, increase the ROIC on their stores from 18% to 25% and decrease the company-owned stores by 267. As I calculated, AAN pays around 250K for closing down stores. Those 267 stores expect to lead to restructuring expenses of approx. $66 Million. We will add those minus the implied tax shield of 21% as debt to the EV and add the $42 Million in restructuring expenses to the EBIT. Subtract 21% Tax and we get to an additional $33 Million in earnings resulting in ca. $100 Million combined earnings.

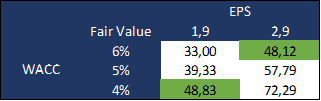

I believe, AAN is worth at least $48 a share and could become as expensive as $72 in my best case. Most of the return will be related to short term multiple expansion from $20.10 to $48.00 rather than earnings growth and dividend returns. My exit price target is between ca. $48 and $60 a share. I expect shares to get to $48 within 12 months and to $60 within 18 months and return between 140% to 200%.

I initiated a position at an average purchase price of $20.10 in NYSE:AAN