Do your own Due Diligence. The author (me) is invested in Northern Bear (AIM: NTBR). I own shares and if you think about buying shares of this business keep in mind that even a small investment from your side will move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Summary Northern Bear PLC

After discovering API GROUP, KINOVO PLC, and INSTALCO AB next to come is Nothern Bear PLC (AIM: NTBR).

This one is super straightforward and this Write-Up is the shortest I wrote so far.

Before I start let me tell you why it is undiscovered:

Former Value Trap due to bad Capital Allocation

Micro-Cap with around £10m in MC

No Write-Ups, No Seeking Alpha Articles, No Twitter Threads

GAAP-Earnings hide the underlying cash-flow generation

And now let me tell you why I believe that this one will at least double over the next 2 years:

The Balance-Sheet Never Looked Better

The Company Trades at Less Than 4x NTM EV/EBIT and Less Than NTM 5x P/E

The Company Is at an Inflection Point

Catalyst: New Activist Shareholder Will Force a Better Capital Allocation

Background

Northern Bear PLC is a boring holding company that consists of 12 businesses across 3 divisions:

Roofing activities (55% of Gross Revenue FY2019)– companies providing a comprehensive range of roofing services including slating, tiling, leadwork, felting, refurbishment, and maintenance for domestic, commercial, and public sector properties;

Materials handling activities (4% of Gross Revenue) - supply service and maintenance of forklift trucks and warehouse equipment both on hire and for sale;

Building services activities (41% of Gross Revenue) - aggregation of other specialist building services companies providing services including building maintenance, refurbishment, fire protection, and sound insulation

Historically, it was IPOed as a construction roll-up in 2006, but what a surprise, it did not work out as expected.

A few years later the subprime mortgage crisis and the company went from £0.90 in 2006 to less than £0.10 in 2012.

Even at the lowest point in time, the company managed to stay profitable while revenues declined.

THE Mismanaged Capital

The core hypothesis here is that as soon as the company starts to allocate capital in a much better way, the multiples will re-rate (or I get at least a 20% dividend yield).

The historical Debt Repayment was destroying shareholder value, while the m&a strategy seemed to be ok.

Debt Repayment

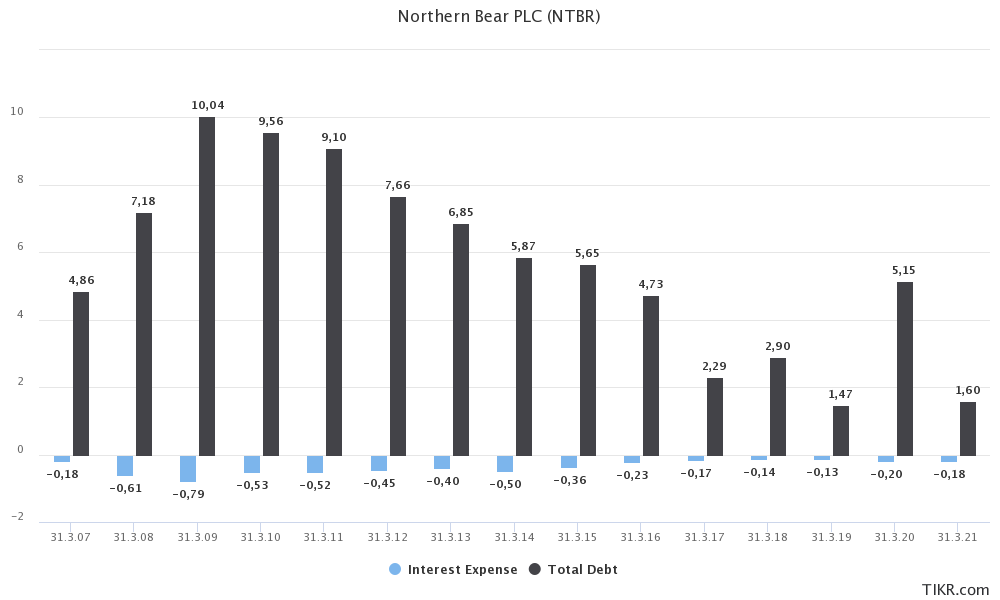

In 2009, the company was indebted and had around £10m in long-term debt. In the following chart, it is noticeable that:

It took them 10 years to get debt down to £1.47m in 2019.

Most of the cash earned from operations was used to pay the loan back.

In 2015, the company started to pay a small dividend

In the next table, you see that the interest rate on the long-term debt was around 8% in 2010 and around 5% in the years after.

The problem here is that every pound that is used to repay the debt has an IRR equal to the interest rate.

Over the last 10 years, NTBR was reinvesting its earnings at an IRR of 5% to 8% while having the choice between

Debt repayment with a 5 to 8% IRR

Buying back shares at 5x to 8x EPS

Paying a 12.5% to 20% Dividend

Do some accreditive acquisitions.

NTBR picked option 1. with the lowest returns while option 2. had the best IRR.

Mergers & Acquisitions

They did one acquisition in 2017.

In 2017, they acquired H. Peel & Sons for a maximum of £2.9m. H. Peel & Sons was providing services for breweries, universities, student unions, hotels, health clubs, schools, care homes, and offices in the UK.

Obviously, the business was hit hard by Covid-19 and NTBR had to write down goodwill in 2020/2021.

The purchase price of £2.9m consists of a) £0.7m cash payable immediately, b) £0.4m deferred cash c) £0.4m in NTBR shares, and d) £1.4m in earn-outs.

H. Peel & Sons finished the year until the 31. August 2016 with a turn-over of £5.4m with a PBT of £0.4m and adj. PBT of £0.5m.

With a UK corporate tax rate of 19%, I get to a profit after tax (PAT) of ca. £0.4m. Without the earn-out, I get to a multiple of ca. 4x PAT and ca. 8x PAT after paying the earn-out.

While 4x PAT is a good rate of return of 25%, 8x PAT doesn't meet my personal hurdle.

At the same time, NTBR reports that the historical adj. PBT was £0.7m. After applying the corporate tax rate I get to £0.567m.

If I assume that the earn-out is exactly tied to the historical profits it would imply a multiple of 5x PAT. 5x PAT is good compared to the 8x PAT above and my m&a capital allocation worries are unjustified.

Historical Multiples

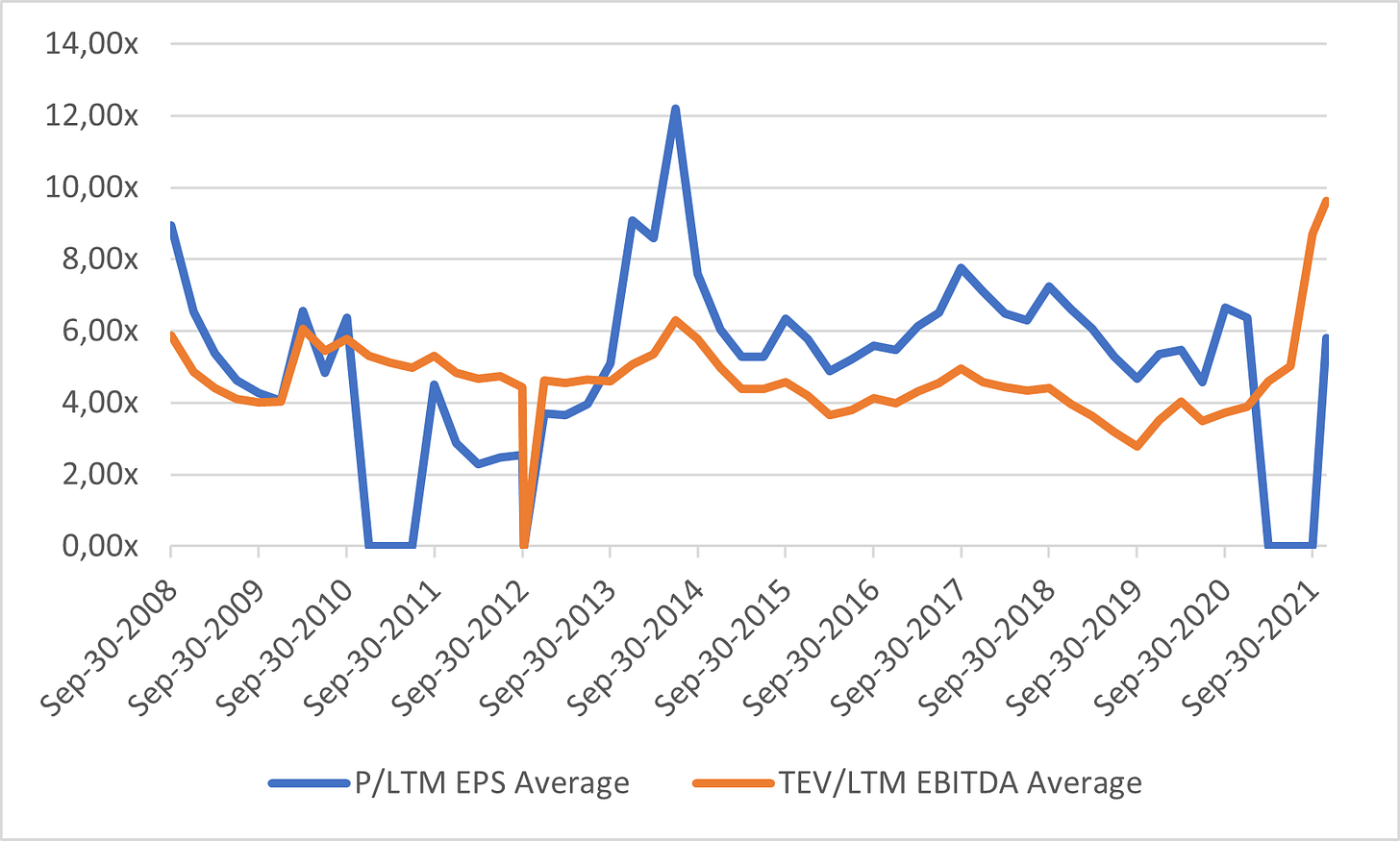

Now, as I understand what the company did with their cash flows, I understand why that company was always trading cheap at super low multiples of 5x to 8x EPS and 4x to 5x EV/EBITDA:

Instead of paying back the debt, the company could have bought back its shares at a consistent IRR of 20% to 12.5%, and today, there would be no shares outstanding anymore.

While the company looked optically cheap, it was clearly a value trap as no money was paid to the shareholders of the business.

Shareholder Activism

In Sept. 2019, NTBR announced a Tender Offer.

On 26 September 2019, Cedarvale Holdings Ltd ("Cedarvale") announced, by means of a regulatory information service announcement (the "Announcement"), its intention to make an offer to acquire up to 5,400,000 ordinary shares in the capital of Northern Bear plc ("Northern Bear"), at 72 pence per Share […]

A Canadian REIT Tycoon called Jeff Baryshnik wants to acquire 29.6% of all shares outstanding and without the intention to acquire all of the shares outstanding.

Cedarvale does not intend to make an offer to acquire the entire issued and to be issued ordinary share capital of Northern Bear pursuant to Rule 2.7 of the Code.

Closely after, NTBR announces the following:

Shareholders should note that if Cedarvale were to acquire all of the Northern Bear Shares it is tendering for or more than 25 per cent. of the Company's share capital it would, thereafter, be able to unilaterally veto any special resolutions proposed by the Board.

The Board was not made aware of the Tender Offer until late on 25 September 2019. The Board takes no position at this time with respect to the Tender Offer

After a few tender attempts, Jeff has acquired 25.6% of NTBR. On the 24th of August 2021, NTBR announces that Jeff becomes the new director of the board, and the former director who is the CEO as well, will step down from the director’s board but will stay in the management of the company.

In the most recent trading update, NTBR mentions the following:

I have commenced a process of engaging with the Board and management to discuss and review the Group's strategy and approach to capital allocation, including the dividend policy.

Once this process is completed, we will provide further information to shareholders.

Our existing policy is to pay only a final dividend, at the Board's discretion, and to assess future dividend levels in line with the Group's relative performance, after taking into account the Group's available cash, working capital requirements, corporate opportunities, debt obligations, and the macro economic environment at the relevant time.

I assume that Jeff is going to allocate capital differently and pursue a much better allocation of capital compared to the past.

Valuation & Catalyst

This one is simple.

I have an EV of 11.5m and the company should be debt-free at the end of next year.

Right now, the company is trading at an MC of 10.8m. I expect annual profits of around 2.4m for next year. Hence, I get the company for less than 5x PAT.

The market will have to realize that the company is not burning cash anymore and most of the profits are distributed to the shareholders or used for higher ROIC projects like share buybacks or accelerated m&a.

A high dividend yield and strong earnings growth will attract shareholders and elevate the current share price.

Second, the largest shareholders right now are

(25.6%) the activist above,

(12.9%) another private person (Nicholas Beaumont-Dark)

(4.4%) the current CEO Steve Roberts

As there are no hedge funds invested right now there exists the opportunity for further buyers.

Risk

The main risk here is that I buy a mediocre asset that is highly tied to the building sector.

I might buy at peak earnings, but I could be lucky and the building sector will maintain current levels for a few more years returning most of my investment.

But even if I am wrong and normalized earnings and revenues should be 50% lower, I will receive a 10% FCF-Yield.

The business is close to debt free and there is no reason to assume that they will have to file for chapter 11.

Final Thoughts

While the capital allocation was mismanaged, It seems that Steve Roberts was giving his best.

Since 2010, he divested several unprofitable business units. He was earning a meager 60k to 100k salary per annum while retaining his 4.4% stake over this time.

He issued a few shares, but never diluted the shareholders in an aggressive way. At the same time, his acquisitions did not seem to be very expensive.

Today, the company is in the best condition and it is the right timing to buy shares of Northern Bear PLC.

Hello b0ss nice write up, how do you find your investment ideas?